Trump's “Tariffs Are Good For the Economy”, Americans Agree.

An exclusive Morning Consult poll out today says Americans are more on board with tariffs than not, even if it means consumer goods might cost them more.

If you have not read “Common Sense” by Thomas Paine, you should. It’s canonic Americana and explains the collective psyche of the plebs. We know women don’t have penises, and men with breast implants are not really women, even if in our penchant not to offend, we happily oblige to call him a her. As Paine said, it is common sense that an island nation should not rule a continental one and we have the resources and know how to build our own industry, rather than import it all from Europe.

Some common sense today, as seen in this exclusive Morning Consult poll, of which I had nothing to do with.

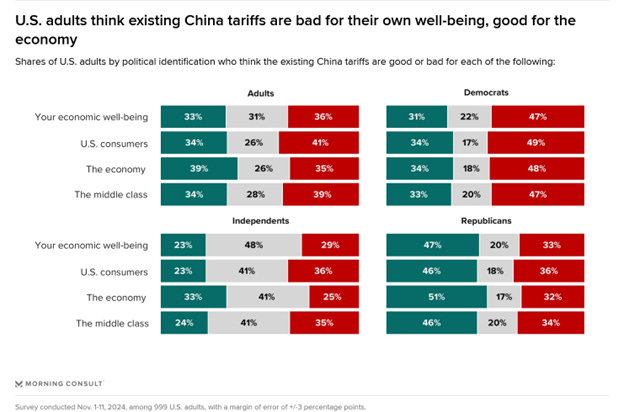

Those surveyed on Trump’s (and Biden’s, let’s not forget the “Big Guy”) tariffs agree that tariffs are good for the economy, even if not so great for the consumer.

China Tariffs Did Not Kill You

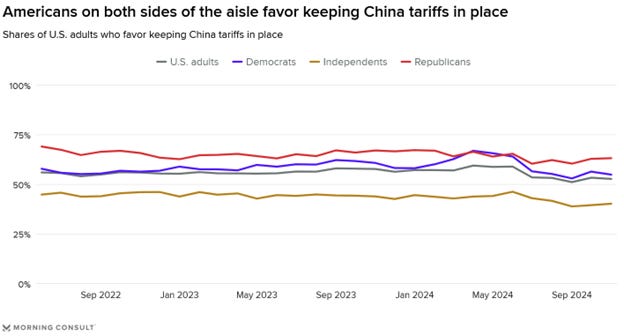

You survived four years of Trump tariffs already. You survived the Section 301 tariffs, the Section 201 solar tariffs, and the Section 232 steel and aluminum tariffs, all imposed by Trump and continued under Biden.

Even Scott Bessent, Trump’s Treasury Secretary pick, said that existing tariffs did not cause inflation and that if your discretionary goods cost too much, you will either look for a lower cost alternative, or refrain from buying.

Tariffs do not impact the non-discretionary things we all buy, like food, electricity, heat, fuel, and professional services like insurance and health care. All of those things went up in price over the last four years, and these are the things that impact us most economically on both an individual level, and the corporate level. If your Nike’s went from $80 to $90, work an hour more this week and you can afford it. Get your son to shovel an elderly person’s driveway or trim their hedges. Should come up with $10, even competing with illegals for the labor!

On China tariffs, at least 54% of Democrats and 63% of Republicans say to keep them, which Biden did on May 14. The Section 301 tariffs are now in place for four more years.

If we put our industrial capacity fully in the hands of the private sector, the big players would all source from Mexico and Asia, where labor goes for single digits per hour, and environmental rules are basically non-existent.

If Washington wants to have an industrial base, and Wall Street wants to have a strong, free-floating currency, then you need some sort of protection and incentives to entice production. If not, Boeing aircraft will still be made here, but all the components inside of it will be imported. The C-130 Hercules is made, at least in part, at Tata Advanced Systems’ factory in Hyderabad, India. I’ve seen it. They make the wings. Lockheed Martin even opts to build our defense systems abroad.

In a free trade free for all the only thing you would make here is a sandwich and maybe some software.

(Yes, the USAF C-130 is partially made in India, especially its rear wings, aka “horizontal and vertical stabilizers”.)

Trump’s 10%: Americans Get It

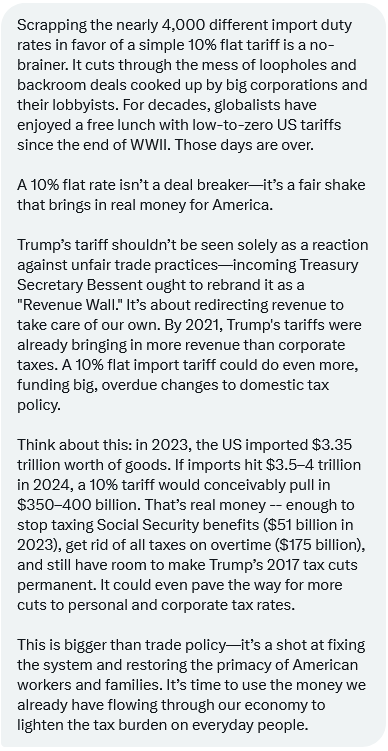

Americans surveyed are on board with Trump’s proposal for a 10% universal tariff, too, which is interesting. This despite the Kamala Harris campaign and the financial experts in The Economist and CNBC telling us we will all go broke and America’s middle class will fork out an additional $4,000 a year in expenses filling their garages with imported kayaks and e-bikes and giant dollhouses.

The 10% tariff proposal is viewed most favorably, with 46% saying those would be “very” or “somewhat” good for the economy. Morning Consult summarized their poll by saying that their respondents think Trump’s proposed tariffs' positive impact on the economy ultimately overrides their concerns about rising consumer costs.

The 10% tariff would not lead to manufacturing coming back to the U.S. Forex rates would weaken against the dollar to eat into that added expense paid by the importer. But the 10% rate would be new revenue for the government. If the government collected 10% on $5 trillion of imported goods, that’d be $500 billion in revenue it can then use instead of federal tax revenue. It can also be used to reduce the roughly $2 trillion fiscal deficit. These are the two things that bring Wall Street on board with the universal 10%. This number seems to be the most palatable to most, though it will not alone be enough to make outsourcing manufacturing less attractive.

Voters “do not have a clear understanding of the mechanics of who pays a tariff”, said Morning Consult, which calls it a tax on imports.

Importers pay the cost of any tariff payable to the U.S. government. This could be American companies paying the tariff, or multinational subsidiaries paying the tariff. So if Polestar is importing seats for the EVs it is making in South Carolina, Polestar’s China owners in the U.S. pay the tariff. About a third of U.S. voters believe that foreign companies exporting goods to the United States are responsible for paying them, rising to 42% if you are a Republican, compared with only 27% of Democrats. The Democrats have it more right than not, though it is way more complicated than that.

Companies also have contracts for goods they import, so if I am Walmart and I said I want to import $500,000 worth of Ralph Lauren bed linens this year and paid it already, or even if I am still making payments, the Ralph Lauren contract manufacturer in China cannot tell Walmart that with 25% tariff added on to them today their bill to Walmart just went up $125,000.

Companies can also offer special deals.

Say the good you import from China is charged 25% but you can contract someone in Vietnam to make it with just a 10% tariff. One of three things will happen:

The China company will come up with some offer to keep the business, perhaps including a line of credit below market rate, or a long-term contract with a locked-in price.

The China company will invest in a new factor in Vietnam, or outsource to Vietnam to make the same good, keeping the business

The importer will leave the China partner altogether and source from Malaysia at a lower tariff, or Mexico where there is no tariff, or if they can do it at home, will make it here instead to avoid supply chain risks due to geopolitical tensions.

Forget currency fluctuation. That also will eat into the tariff hike. Our dollar goes further abroad. It’s why we outsource most of what we consume.

Vladimir Signorelli from Bretton Woods Research said:

Voters’ belief that the U.S. government imposes tariffs to protect and/or grow domestic industries — and by extension, U.S. jobs — suggests they are mentally balancing this perceived plus against the risk that they will have to pay more for imported products.

Smarty Pants takes us to school. Some Canada and Mexico Trade 101

“Trump’s 25% tariff threat gets people a little nervous, according to Morning Consult. It’s unlikely to be imposed, but instead will be used as leverage to get Mexico to police its border. Mexico’s president Sheinbaum said that policing the U.S. border is not her responsibility and that the Biden administration told them to let the caravans through. Now Trump is saying to knock it off and I am sure they will oblige or risk the 25%. The truth is that Mexico and Canada gain a lot from selling into the U.S. Our trade is out of whack. In 2017, our deficit with Canada was around $18 billion. It hit a record $70 billion or so in 2022 and was over $60 billion last year. Our deficit with Mexico is second only to China today, now over $150 billion. In 2018, it was $77 billion. The trend is clear. We absorb way more of Mexico and Canada’s production since 2018, by a factor of two.”

Recommended Tweets:

Steel company can’t handle the Mexicanos. Closing factories due to import penetration:

https://x.com/Charles_Benoit/status/1864322335165087996

Brad Setser on why no Lighthizer: https://x.com/Brad_Setser/status/1864121345061110181

Recommended Reading:

How a Global 10% Tariffs on U.S. Imports Would Raise Incomes and Pay for Large Income Tax Cuts for Lower/Middle Class, by Jeff Ferry, Chief Economist, Coalition for a Prosperous America