The Korea US Free Trade Deal Is Dead. Mexico And Canada Are Next.

On July 7, Trump sent a letter to South Korea and 13 other countries announcing new tariff rates. With South Korea's rate at 25%, their old free trade deal is now dead.

The Korea-U.S. Free Trade Agreement (KORUS) is now officially dead. Trump announced 25% tariffs on South Korea on Tuesday, effectively signalling the end of the 18 year old free trade deal.

I don’t know what to tell you, other than live with it: free trade is a thing of the past. The ex-Democrats turned new-Republicans killed it.

Nothing in Trump’s letter to South Korea suggested that these were negotiable. In fact, they were negotiable starting on April 2, the so-called Liberation Day, and were put on pause for 90-days. That’s when it was negotiable.

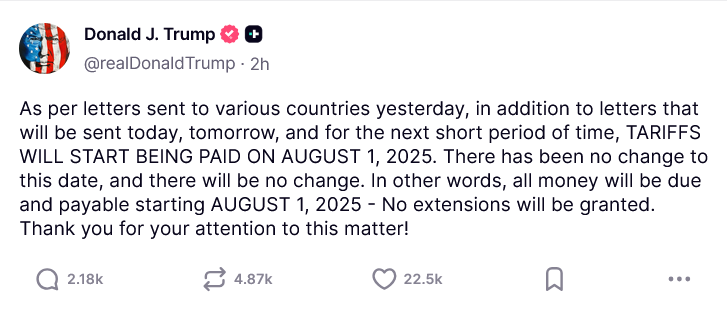

The 25% tariff goes into effect Aug. 1, thus extending the 90 day pause for another three weeks. And while the market wants Trump to pause for 12 months, this is a non-starter argument. It’s like telling the Russians there is going to be a cease fire in Ukraine (so Ukraine can reload). If the Republicans lose the mid-terms, Trump will be mired in impeachment and other theater kid dramas from Democrats and their favorite judges. That could trip up his entire agenda, including his America First trade policy.

Remember that these tariffs are the International Emergency Economic Powers Act (IEEPA) tariffs from April 2, the same tariffs that the Court of International Trade in New York said were illegal on May 28. On May 29, the Trump administration got a stay on that order and now the U.S. Court of Appeals for the Federal Circuit is reviewing this. We could have a judgement three weeks after these things go into effect in the first place, meaning one of three things (only one good for Trump):

Tariffs are deemed legal.

Tariffs are deemed partially legally, but the 10% baseline rate or the 20% fentanyl tariff rate on China has to go. If so, China’s tariffs fall to around 35% and Southeast Asian tariffs fall back to between a low of 10% for Vietnam to 30% for Myanmar, for example.

IEEPA tariffs are illegal and the Trump administration has to pay everyone back. This would be a complete disaster and require a backup plan, which is doable, but very messy and a bad look, overall.

Still, the biggest takeaway here is that Trump is willing to kill an FTA just like that. This means that Korea will likely be forced to retaliate and raise tariffs on American goods that were once duty free. Trump threatened to raise tariffs further if a country did this. I don’t know if he will do that to the Koreans after just killing their free trade agreement, though according to his letter here, he will!

What I’m thinking now is “shots fired” against the USMCA. That agreement gets revisited next year. If renewed, it’s good to go for 30 years. But I suspect at this point it will not be renewed. I don’t know the odds, but I would say they are closer to 50/50 this week than they were last week.

The USMCA (old NAFTA) was created largely for U.S. auto makers, but it has quickly become a free trade zone for Asian and German auto makers in Mexico. They now face Section 232 tariffs of 25% if their finished vehicle or automotive parts do not meet local content requirements of 60% (parts) to 70% (cars) North American made. Mexico is also in the hot seat on steel tariffs and is likely to eventually move to managed trade, such as quotas, for example, on a number of steel goods. Other goods also being considered, including agricultural goods produced here in competition with Mexico.

Meanwhile, the Asian tariffs are still lower than mainland China tariffs, meaning the region is still an attractive spot for Chinese multinationals to invest, or to outsource. For now, the only countries with low entry barriers to the U.S. are Mexico and Canada. Next year, that could change.

Next up will be India, EU and Latin America tariffs. I suspect most Latin America tariffs will be around 10% to 20% max, with India and the EU closer to 20%. In May, the EU was our biggest source of the goods deficit, followed by Mexico and Vietnam. China is now in fourth place because of the tariff wall.

Vietnam got lucky with the lowest tariff rate of the Southeast Asian manufacturers. This is likely due to Vietnam being the only country in the region that was overtly trying to make a deal since Liberation Day. And I suspect they got a better deal because American multinationals have chose Vietnam as its China+1 strategy (see Nike, for example) over the last 10 years. Some might argue that it is because Vietnam agreed to open its market to American exports. We shall see.

U.S. exports are not the growth story. U.S. consumers and U.S. companies making things for those consumers…that’s the growth story.

Vietnam’s lower duty rate will likely keep her a hot spot for China and all the other American multinationals that have set up shop or contracted out from there, causing our deficit with Vietnam to surpass our deficit with China for the month of May for the first time.