China Corporations Are Taking Over Markets in Latin America

Once a stronghold of Western companies, led by the United States, Chinese multinationals are eating into market share of the former corporate colonial powers. Some examples below.

Since the days the Spanish galleons sailed the seven seas and encountered the alien lives of the Mayans; from the time Portuguese governments were bringing slaves from their colonies in Angola, Sao Tome, and Guinea Bissau to Brazil; up to the post-World War period when Washington DC used its soft power to develop the region and make them staunch allies of America by setting up Ford assembly lines (and teaming Frank Sinatra with Tom Jobim), Latin America was an outpost of Western corporations and culture. For the United States, those days largely remain. For the Europeans, it’s basically over.

Richard Nixon got the ball rolling. He could never have imagined the future this way. Unlike what Obama would later call “the Asia pivot”, Nixon’s actions were decisively a China pivot. Maybe if we got them to make our Christmas ornaments and Happy Meal toys, we could make sure the CCP would not join forces with the CCCP, aka the Soviet Union.

Money trickled into the Chinese economy to make low-budget goods for us consumers. New CCP leaders like Deng Xiaoping took to “opening up” China to the world to modernize and better compete with the riches and might of the West.

Some Chinese took that to mean China could become like one big Hong Kong – then still a colony of the British – or maybe one big Taiwan. They were run over in Tiananmen Square. At the time, the U.S. imperial capitol was so interested in growing China as our go-to manufacturing base, that the Republican leadership in the White House overlooked it.

A little over 10 years later, China became a member of the World Trade Organization, giving it near duty-free access to the U.S. market (our baseline tariff rate for Most Favored Nations is around 3.5%). China quickly went from making Happy Meal Toys and Hasbro playsets to Lenovo laptops and TikTok.

Today, China is sailing into the Americas. For Chinese capital and political leaders, it is a new world. They have replaced any European presence and, in many instances, are rivaling the U.S. or beating us in market share on big ticket items like cars and cell phones.

The West wanted China to be a big part of its globalist agenda. China was fine with that. Only they were apparently not so fine with being the guys who break crystalline stone in flip-flops and rummage through trash for recycled metal to melt into steel. No. The Chinese wanted their own national champions and wanted to be leaders in major industries. If the Japanese and South Koreans can do it with a third of the population and fewer natural resources, so can we, the Chinese must have thought.

Like their Asian neighbors, the Chinese have their own rivals to Western brands now. Their presence is increasingly seen in Latin America, where they are beating the old colonial gringoes at their own game. On matters of trade alone, Japan and South Korea are puny in comparison.

For Latin America, China is the most important country after the United States. But for some individual countries today, China is even more important from an economic perspective. And it is this perspective that drives all political narratives in Latin America.

Brazilians don’t vote for the guy who believes in 21 genders and follows “the science”. They vote for the guy who promises them, as the saying goes throughout the region, a “chicken in every pot.”

Some examples:

Satellite Internet. Brazil’s Leftwing Hates Elon Musk, So…

Brazil has entered into an agreement with China's Shanghai Yuanxin Satellite Technology, also known as SpaceSail, to provide satellite internet services in remote areas of the country. This partnership aims to replace existing services like SpaceX's Starlink.

SpaceSail, founded by Jie Zheng and based in Shanghai plans to commence formal commercial services in Brazil by 2026, utilizing its Qianfan ("Thousand Sails") satellite constellation. The company has already launched 36 satellites and aims to deploy over 600 by the end of 2025 to enhance its service capabilities.

By comparison, SpaceX has a reported 7,000 Starlink satellites with a goal of 34,400. Prices are similar for users. SpaceSail is only in Brazil or will be.

If you want a low earth orbit satellite to get online, you have two guys: Elon Musk or Jie Zheng.

Thanks to Elon, America is in the game. And thanks to Elon, Jie is in the game as nobody copies like the Chinese. Europe is nowhere to be seen. They’re probably still using dial-up modems.

China’s EVs are No. 1. Ford is Gone. BYD Arrives.

The biggest car market in Latin America is Brazil. Chery, Great Wall (bought Mercedes Benz factory in Sao Paulo) and BYD are all making cars there. GAC Motors, a smaller player, has announced plans to build a factory in Brazil. The EV and hybrid market is small in Brazil, but BYD Dolphin Mini, Volvo XC40 Recharge (owned by Geely, which is Chinese) and the BYD Yuan Plus are the best-selling EVs there.

GM makes cars in Brazil still and is investing. Ford is out. Tesla is not there. Volkswagen, Audi, and BMW are still manufacturing in Brazil.

Tesla is No. 1 in Mexico, but the JAC E10X is the second most sold EV there, and that’s Chinese.

The Ford Mustang Mach-E and the Chevrolet Blazer EV are made in Mexico, but these are for export. Ford sold just 66 Mach E’s in 2023 and so far this year sold 100 as of September. The JAC E10X sold 10x that amount.

Apple Only Big In Mexico. China Beats It Everywhere Else.

Brazil, Mexico, and Argentina are the top three cell market markets.

Brazil’s top three brands are Samsung (38% market share), Motorola (Lenovo owns it so it is a Chinese corporation though some models are made in Brazil; 25% market share) and Xiaomi (19.9%), which is Chinese.

As of November 2024, Apple's iPhone holds approximately 7.82% of the smartphone market in Brazil. Apple is shrinking. Xiaomi is growing.

This was Apple’s market share in 2020.

Mexico’s top brands are Samsung (25%), followed by Motorola and Apple.

As of March 2024, Xiaomi held approximately 11.5% of the smartphone market in Mexico, making it the most popular Chinese smartphone brand in the country. And in March 2024, Huawei accounted for around 5.5% of the Mexican smartphone market. Combined, that’s 17% of the market for native Chinese brands, and although I have not been able to confirm Motorola’s market position, let’s say it’s 20% -- so give the Chinese entities over a third of the Mexican cell phone market.

Argentina’s top cell phone brands are Samsung, Motorola and Xiaomi, which alone has a 6% market share. Besides the South Koreans, Chinese corporations (Motorola and Xiaomi) own Argentina’s cell phone space.

E-Commerce: Argentina’s Native Platform Rules. China Gains. Europe Asleep.

The Argentinian-created company, Mercado Libre (MELI), rules the roost in Latin America.

Brazil’s top three e-commerce platforms are Mercado Libre, Shopee and Amazon.

AliExpress, owned by Alibaba (BABA), is around No. 4 in Brazil. Shopee (SE) is Singaporean but was founded in 2009 by a Chinese entrepreneur living in Singapore named Forrest Li. Chinese tech company Tencent owns around 15% to 18% of the company’s shares. Ali Express and Shopee’s combined market share is bigger than Amazon Brasil.

Argentina’s top e-commerce platforms are Mercado Livre, Amazon, and AliExpress, which is in a distant third and about two times smaller than Amazon. Mexico’s top e-commerce platforms are the same.

We have China and the U.S. competing head-to-head in Latin America, but so far Mercado Livre, as an early entrant, is the standard. It is more likely that people use Amazon to buy U.S.-trending or U.S.-style goods and AliExpress is used by small businesses that import from China in bulk to rebrand and sell at marked-up rates.

American Tech Dominates Latin America’s Cloud; But China Coming In Hot

In Latin America overall, Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform are the main cloud providers. Huawei Cloud and Alibaba Cloud are muscling in.

Huawei was a top four cloud in the region in 2021 and in May, Alibaba Cloud announced plans to establish its first cloud region in Mexico.

European players are mostly staying in Europe. France company Atos and Deutsch Telekom’s T-Systems are in Brazil, for example, but cloud services are not their core business there.

Laptops: Lenovo Keeps China’s Stamp on PC Market

It’s been a while since China bought IBM’s Think Pad and renamed the company Lenovo. Now they are everywhere. U.S. brands are still the biggest. Some of the U.S. brands are made in Brazil, so they are not all China imports like our laptops.

Brazil’s top brands are Dell, Apple, and Samsung. Mexico’s biggest PC brands are Hewlett Packard, Dell, and Lenovo which had around a 22.1% market share in 2022 up from 15% in 2015.

Lenovo is also a top three in Argentina, competing with Samsung and HP and competing with HP and Dell in Colombia for the top three.

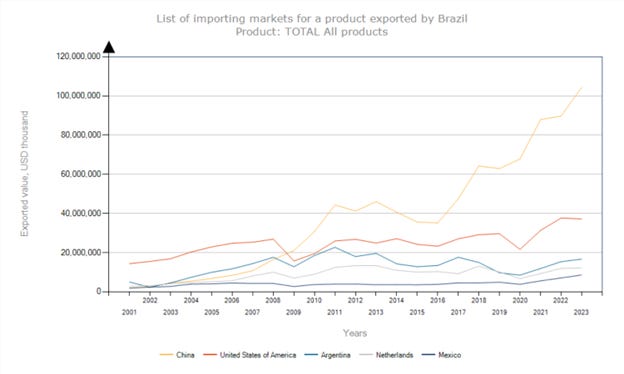

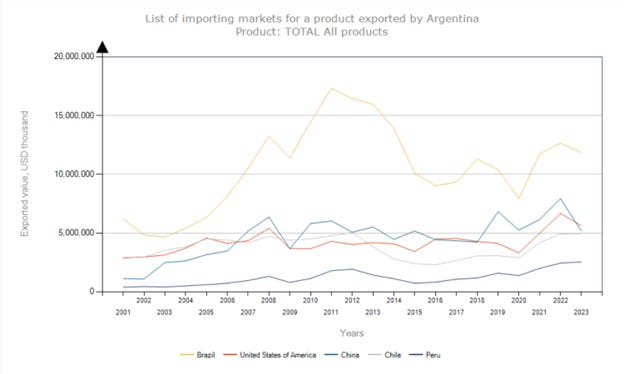

China Rivals, or Beats, the United States in LatAm Trade.

This data uses individual countries, so the European Union data might look sexier if treated as one.

Brazil:

Mexico:

Argentina:

The United States still dominates the region culturally and most tech products, if not native Brazilian or Argentinian, are going to be American IP, like Adobe or Microsoft Office, for example.

Europe lost its former colonies here many years ago to the Americans. But now they’ve doubly lost it to the Chinese.

China will unlikely ever connect with the Latino’s culturally. The Americas belongs to the Americans, north or south. But Chinese companies and brands will continue to eat into the market of American ones. Brazilians and Mexicans will go to the Barbie Movie before they see Wolf Warrior III. But they will download TikTok more than the download Snapchat and in Brazil they might see the movie in a theater owned by a Chinese multinational (UCI Cinemas is owned by AMC Theaters, which is the Dalian Wanda Group from China).

The market battle in LatAm is between local companies, Americans and Chinese. The Europeans might have their niche in things like heavy machinery or deep sea oil drilling, but the all-important tech and automobile market will be left for the Americans and Chinese to carve out their turf in the region for many years to come, leaving many European companies behind.

Recommended Reading: “Tariffs are not a Dirty Word,” says Michael Pettis in the FT

https://www.ft.com/content/3c95a4cd-2dcb-46d8-8cf6-606ab5e28c51